中东的几个国家正在大力投资可再生能源替代品,计划到2030年前在全球低碳氢气市场占25%的份额

到2024年前,中东地区的可再生能源产能预计将再次翻一番;到2030年结束前,太阳能发电将占中东地区电力结构的15%左右

沙特阿拉伯的目标是成为世界上最便宜的绿色氢气生产国,价格为每公斤1美元,私营公司正在通过46个价值920亿美元的可行项目寻求从中分一杯羹

中国石化新闻网讯 据油价网2023年3月16日报道,为了应对全球对化石燃料的强劲需求,中东地区的许多国家仍在继续将石油和天然气列入议程,中东地区的一些国家也在大力投资可再生替代能源。对于沙特阿拉伯和阿联酋等许多中东国家来说,石油和天然气继续提供收入,以支撑强劲的经济,并为国家基金作出贡献,以确保未来的财富。然而,中东地区各国领导人都意识到,石油和天然气不会永远是主要的经济驱动力,许多国家目前正试图实现经济多元化,扩大非石油部门。拥有丰富能源经历的中东地区被视为发展绿色能源业务的理想地点,从绿色氢能到风能和太阳能,它将确保中东地区未来的能源安全及其在未来国际能源舞台上的地位。

与世界上许多其他国家一样,中东地区的几个国家先后宣布了雄心勃勃的脱碳计划,以符合《巴黎协定》规定的目标。根据2019年的评估,中东地区可再生能源市场预计在2019年至2028年之间将实现13.43%的复合年增长率,在为响应联合国气候变化峰会而加速几个绿色能源项目之后,这一数字可能会更高。

尽管计划提高石油和天然气产量以满足全球需求,但中东地区许多国家都有绿色替代能源的宏伟计划。中东地区的可再生能源装机容量在2010年至2020年间翻了一番,达到40吉瓦,到2024年还将再翻一番。随着整个地区的高太阳照射,中东地区将在未来几年推出几个太阳能发电场。到2030年结束前,这种太阳能发电预计将占中东地区电力结构的15%左右。

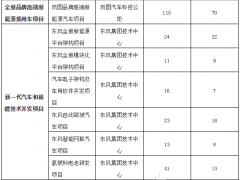

中东地区也在寻求击败其主要竞争对手——欧洲和亚洲,以期主导全球绿色氢气市场。2021年,阿联酋宣布了几个新项目。法国Engie公司和总部位于阿布扎比的可再生能源公司马斯达尔表示,他们将向阿联酋的绿色氢气产业投资50亿美元,目标是到2030年前电解槽产能达到2吉瓦。迪拜推出了中东地区“首个工业规模”的绿色氢气工厂。阿联酋表示,计划到2030年前在全球低碳氢气市场中占25%的份额。与此同时,沙特阿拉伯宣布与沙特电力开发商ACWA Power和阿曼石油和空气产品公司达成一项70亿美元的协议,在阿曼的塞拉莱免税区生产绿色氢气。阿曼还宣布,希望到2040年前建立以氢气为中心的经济,拥有30吉瓦的绿色氢气和蓝色氢气。

自2021年以来,中东地区的绿色氢气市场大幅扩大。由于在研发方面的重大投资,沙特阿拉伯已经能够降低绿色氢气生产的成本,使绿色氢气更具吸引力。沙特阿拉伯现在的目标是实现每公斤绿色氢气价格1美元,使其成为世界上最便宜的绿色氢气生产国。一些私营公司也在寻求分一杯羹,德国西门子公司在中东地区确定了46个可行的绿色氢气项目,总价值为920亿美元。阿联酋和阿曼以及沙特阿拉伯都显示出了巨大的投资潜力。

清洁能源计划并没有止步于绿色氢气,因为阿联酋的目标是到2050年前将可再生能源占其总能源结构的比例提高到75%。在阿布扎比,Al Dhafra太阳能项目预计将在COP28召开之前投产。这个太阳能发电场的发电能力为2吉瓦,可为16万户家庭提供足够的电力。阿联酋国有能源公司塔卡和马斯达尔拥有这个项目60%的股份,其余股份由法国电力可再生能源公司和亚洲某领先电力技术公司组成的国际财团拥有。两家公司希望通过这个项目创造4000个就业岗位。这个项目将得到其它大型太阳能项目的支持,包括39亿美元的950兆瓦的诺尔能源-1发电场和阿联酋第一个风力发电场——哈塔风力发电项目,这两个项目都在迪拜。

沙特阿拉伯还计划到2030年前绿色能源占其能源结构的50%。这个目标将受到全国太阳能项目加速发展的推动,如利雅得的1500兆瓦Sudair太阳能发电厂和玛娜的Manah I和II太阳能发电设施。对碳捕获和储存(CCS)技术的投资也将帮助沙特阿拉伯的石油和天然气业务脱碳。也许最雄心勃勃的计划是,沙特阿拉伯正在建设一个名为NEOM的未来超大城市。沙特阿拉伯王国计划投资800亿美元用于位于本国西北部的这个大型项目的开发,以创建一个横跨比利时大小规模的城市。其目标是创造一个未来的空间,没有汽车,没有道路,也没有温室气体排放,将由100%的可再生能源提供动力,95%的土地被保护为大自然状态。这座城市的建设已经开始,尽管专家们对这个项目能否实现表示怀疑。

中东地区将成为全球一个能源大区,这得益于其长期以来对石油和天然气行业的持续投入,以及对中东地区可再生能源未来的重大投资。沙特阿拉伯和阿联酋很可能会走在中东地区绿色能源革命的前沿,两国计划大力发展绿色氢气、太阳能、风能和其他创新绿色技术。

李峻 编译自 油价网

原文如下:

The Middle East Is Looking To Dominate The Green Hydrogen Market

· Several countries in the Middle East are investing heavily in renewable energy alternatives, with plans to achieve a 25 percent share of the global low-carbon hydrogen market by 2030.

· The region's renewable energy capacity is expected to double again by 2024, with solar power set to account for around 15 percent of the region's power mix by the end of the decade.

· Saudi Arabia aims to become the world's cheapest green hydrogen producer at $1 per kg and private companies are looking for a piece of the action with 46 viable projects worth $92 billion.

While many countries across the Middle East are continuing to pursue oil and gas agendas, responding to the strong global demand for fossil fuels, several countries across the region are also investing heavily in renewable alternatives. For many countries, such as Saudi Arabia and the UAE, oil and gas continue to provide the revenues to support a strong economy and contribute to their national funds to ensure their wealth for the future. However, leaders across the region are aware that oil and gas will not be the main economic drivers forever, and many are now attempting to diversify their economies and expand their non-oil sectors. With extensive experience in energy, the Middle East is seen as the perfect location to develop green energy operations, from green hydrogen to wind and solar power, ensuring the future of the region’s energy security as well as its position on the energy stage of the future.

Like many other countries worldwide, several Middle Eastern states have announced ambitious decarbonisation plans in line with Paris Agreement targets. based on a 2019 assessment, the Middle Eastern renewable energy market is expected to achieve a CAGR of 13.43 percent between 2019 and 2028, a figure that will likely be much higher following the acceleration of several green energy projects in response to the COP climate summits.

Despite plans to boost oil and gas production in line with global demand, many countries across the region have big plans for green alternatives. The Middle East’s renewable energy capacity doubled to 40GW between 2010 and 2020 and is set to double again by 2024. With high solar irradiation across the region, the Middle East will roll out several solar farms in the coming years. The energy source is expected to account for around 15 percent of the region’s power mix by the end of the decade.

The Middle East is also looking to beat its main competitors – Europe and Asia, to dominate the green hydrogen market. In 2021, the UAE announced several new projects. France’s Engie and Abu Dhabi-based renewable energy business Masdar stated they would be investing $5 billion in the country’s green hydrogen industry, aiming for an electrolyser capacity of 2 gigawatts by 2030. And Dubai launched the region’s ‘first industrial scale’ green hydrogen plant. The UAE has stated it plans to achieve a 25 percent share of the global low-carbon hydrogen market by 2030. Meanwhile, Saudi Arabia announced a $7-billion agreement to produce green hydrogen in Oman’s Salalah free zone with ACWA Power and Omanoil and Air Products. Oman also announced it hoped to establish a hydrogen-centric economy by 2040, with 30GW of green and blue hydrogen.

And since 2021, the region’s green hydrogen market has expanded significantly. Thanks to major investments in research and development, Saudi Arabia has been able to drive down the costs of green hydrogen production to make it more attractive. The state is now aiming to achieve $1 per kg to make it the cheapest green hydrogen producer in the world. And several private companies are looking for a piece of the action, with Siemens identifying 46 viable green hydrogen projects in the region with a combined value of $92 billion. Both the UAE and Oman were identified as showing major investment potential, as well as Saudi Arabia.

And the clean energy plans don’t stop at green hydrogen, as the UAE aims to increase the contribution of renewable energy to its total energy mix to 75 percent by 2050. In Abu Dhabi, the Al Dhafra Solar Project is expected to come online ahead of COP28. The solar farm will have a 2GW capacity and provide enough electricity for 160,000 households. State-owned Emirati companies TAQA and Masdar own 60 percent of the project, with the remainder owned by a consortium of EDF Renewables and a leading power technology company in Asia. The companies hope to create 4,000 jobs through the project. This will be supported by other major solar projects including the $3.9-billion 950-MW Noor Energy 1 farm and the country’s first wind farm – the Hatta Wind Power Project, both in Dubai.

Saudi Arabia also aims to generate 50 percent of its energy from green sources by 2030. This will be driven by the acceleration of solar energy projects across the country, such as the 1,500-MW Sudair Solar Power Plant in Riyadh and the Manah I & II solar power facilities in Manah. Investment in carbon capture and storage (CCS) technologies will also help Saudi Arabia decarbonise its oil and gas operations. And perhaps most ambitious of all, Saudi is aiming to construct a futuristic gigacity called NEOM. The Kingdom aims to spend $80 billion on the development of the megaproject in the northwest of the country, to create a city that will span the size of Belgium. The aim is to create a futuristic space with no cars, roads, or greenhouse gas emissions that will be powered by 100 percent renewable energy, with 95 percent of the land being preserved for nature. Construction on the city has already begun, although experts have doubts over whether the project is achievable.

The Middle East is set to become an energy powerhouse thanks to the ongoing dedication to its long-established oil and gas industry as well as major investments in the future of the region’s renewables. Saudi Arabia and the UAE will likely be at the forefront of the region’s green energy revolution, with massive plans for green hydrogen, as well as solar and wind energy and other innovative green technologies.

微信客服

微信客服 微信公众号

微信公众号

0 条