| Yingli Green Energy Reports Second Quarter 2011 Results | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Quarterly Shipment Increased by 36.6% to Reach a Historical High Diluted EPS Was US$0.36 BAODING, China, Aug. 19, 2011 /PRNewswire via COMTEX/ -- Yingli Green Energy Holding Company Limited (NYSE: YGE) ("Yingli Green Energy" or the "Company"), a leading solar energy company and one of the world's largest vertically integrated photovoltaic manufacturers, which markets its products under the brand "Yingli Solar," today announced its unaudited consolidated financial results for the quarter ended June 30, 2011.

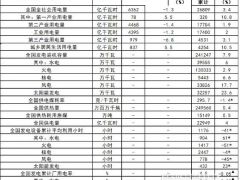

Second Quarter 2011 Consolidated Financial and Operating Highlights

"I'm pleased to announce that we had our best quarter ever in terms of PV module shipments, which increased by 36.6% over the previous quarter. With the significantly increased shipments, we managed not only to expand our global market share, but also to extend our sales geographies," commented Mr. Liansheng Miao, Chairman and Chief Executive Officer of Yingli Green Energy. "The increased shipments were primarily attributable to the improved market conditions, solid management execution and our diversified customer portfolio," Mr. Miao continued. "During Intersolar Europe in June, we saw the sign of demand recovery triggered by the drop of module price. In addition to the enhanced cooperation with existing customers, we have been actively developing new customers. During the first half of 2011, we successfully gained 46 new customers, who contributed approximately 90 MW of PV module shipments." "Our efforts on developing new markets are reflected by our leading presence in markets such as North America and China. With cumulative shipments of 250 MW to 23 U.S. states, Canada, Mexico and the Caribbean, we have become a leading module supplier in North America and expect to capture nearly 15% of the North American solar market in 2011. As a solar pioneer based in China, we have been firmly committed to our domestic market and established a strong market position. With the announcement of the unified national solar feed-in-tariff, we are expecting a stronger growth in China in the years to come." "In light of the strong demand for our products, I'm pleased to announce that we have just brought online another 700 MW capacity, including 600 MW in our Baoding headquarters and 100 MW in Hainan Province. We expect the new capacities to be fully released before the end of this year, bringing our total designed capacity to 1.7 GW." "To facilitate our global growth strategy, we have enhanced our cooperation with FIFA by becoming an official sponsor of the 2014 FIFA World Cup(TM) in Brazil. We believe this continued sponsorship will provide valuable brand exposure not only to Brazil but all around the world. Furthermore, we have become the first official renewable energy partner of U.S. Soccer, the governing body for soccer in the United States. We consider this association to be a platform for building a lasting brand and a recognizable presence in the U.S.," Mr. Miao concluded. Second Quarter 2011 Financial Results Total Net Revenues Total net revenues were RMB 4,398.8 million (US$680.6 million) in the second quarter of 2011, an increase of 27.4% from RMB 3,453.0 million in the first quarter of 2011 and 62.9% from RMB 2,699.6 million in the second quarter of 2010. The significant increase in total net revenues from the previous quarter was primarily attributable to an increase of 36.6% in PV module shipment to our continuously expanded and diversified customer base, partially offset by the decline in the average selling price. Gross Profit and Gross Margin Gross profit was RMB 970.1 million (US$150.1 million) in the second quarter of 2011, an increase of 2.8% from RMB 943.7 million in the first quarter of 2011 and 7.2% from RMB 905.1 million in the second quarter of 2010. Overall gross margin was 22.1% in the second quarter of 2011, compared to overall gross margin of 27.3% in the first quarter of 2011 and 33.5% in the second quarter of 2010. The decrease in gross margin quarter over quarter was primarily caused by the decline of average selling price. Operating Expenses Operating expenses were RMB 443.7 million (US$68.7 million) in the second quarter of 2011, compared to RMB 375.5 million in the first quarter of 2011 and RMB 339.7 million in the second quarter of 2010. The increase from the first quarter of 2011 was consistent with the Company's expanded scale of operations and was also due to our increased investment expenditure on the research and development to further improve cell conversion efficiency and yield rates. Operating expenses as a percentage of total net revenues were 10.1% in the second quarter of 2011, a decrease from 10.9% in the first quarter of 2011 and 12.6% in the second quarter of 2010. The decrease in operating expenses as a percentage of total net revenues was attributable to our improved control over selling, general and administrative expenses, as well as expanded economies of scale. Operating Income and Margin As a result of the foregoing, operating income was RMB 526.4 million (US$81.4 million) in the second quarter of 2011, compared to RMB 568.2 million in the first quarter of 2011 and RMB 565.4 million in the second quarter of 2010. Operating margin was 12.0% in the second quarter of 2011, compared to 16.5% in the first quarter of 2011 and 20.9% in the second quarter of 2010. Interest Expense Interest expense was RMB 157.8 million (US$24.4 million) in the second quarter of 2011, compared to RMB 130.5 million in the first quarter of 2011 and RMB 73.0 million in the second quarter of 2010. The increase in interest expense was primarily due to our increased indebtedness as well as the rise of interest rates. As of June 30, 2011, the Company had an aggregate of RMB 12,144.9 million (US$1,879.0 million) borrowings, medium-term notes and convertible notes, an increase of 18.5% from RMB 10,245.4 million as of March 31, 2011. The weighted average interest rate for these borrowings was 6.44% in the second quarter of 2011, an increase from 5.72% in the first quarter of 2011. Foreign Currency Exchange Gains (Losses) Foreign currency exchange gain was RMB 35.5 million (US$5.5 million) in the second quarter of 2011, compared to RMB 61.2 million in the first quarter of 2011 and a foreign currency exchange loss of RMB 158.6 million in the second quarter of 2010. The foreign currency exchange gain was primarily attributable to the appreciation of the Euro against the Renminbi. Other Income Other income was RMB 55.2 million (US$8.5 million) in the second quarter of 2011, in which RMB 52.2 million (US$8.1 million) was attributable to the gain on bargain purchase from an acquisition made in April, 2011. The acquired company was a PRC private solar product manufacturer that provided processing service to the Company prior to the acquisition. Income Tax Expense Income tax expense was RMB 73.5 million (US$11.4 million) in the second quarter of 2011, a decrease of 4.2% from RMB 76.8 million in the first quarter of 2011 and an increase of 11.6% from RMB 65.9 million in the second quarter of 2010. Net Income Net income was RMB 375.6 million (US$58.1 million) in the second quarter of 2011, compared to RMB 368.3 million in the first quarter of 2011 and RMB 217.8 million in the second quarter of 2010. Diluted earnings per ordinary share and per ADS were RMB 2.34(US$0.36), compared to RMB 2.29 in the first quarter of 2011 and RMB 1.41 in the second quarter of 2010. On an adjusted non-GAAP basis, net income was RMB 354.0 million (US$54.8 million) in the second quarter of 2011, compared to RMB 403.6 million in the first quarter of 2011 and RMB 261.0 million in the second quarter of 2010. Adjusted non-GAAP diluted earnings per ordinary share and per ADS were RMB 2.21(US$0.34), compared to RMB 2.51 in the first quarter of 2011 and RMB 1.69 in the second quarter of 2010. Balance Sheet Analysis As of June 30, 2011, Yingli Green Energy had RMB 7,063.4 million (US$1,092.8 million) in cash and restricted cash, compared to RMB 6,038.3 million as of March 31, 2011. As of June 30, 2011, inventory was RMB 2,556.1 million (US395.5 million), and decreased by 15.3% from RMB 3,018.9 million as of March 31, 2011. Inventory turnover days in the second quarter largely decreased to 67 days from 108 days in the first quarter of 2011. As of June 30, 2011, accounts receivable were RMB 2,999.0 million (US$464.0 million), an increase from RMB 2,525.4 million as of March 31, 2011. Days sales outstanding has been reduced to 61 days in the second quarter of 2011 from 66 days in the first quarter of 2011. As of June 30, 2011, working capital representing current assets less current liabilities was RMB 2,174.9 million (US$336.5 million), compared to RMB 2,925.3 million as of March 31, 2011. As of the date of this press release, the Company had approximately RMB 7,710.1 million in unutilized short-term lines of credit, and RMB 942.0 million committed long term facility that can be drawn down in the near future. Business Outlook for Full Year 2011 Based on current market and operating conditions, estimated production capacity and forecasted customer demand, the Company reaffirms its PV module shipment target to be in the estimated range of 1,700 MW to 1,750 MW for fiscal year 2011, which represents an increase of 60.1% to 64.8% compared to fiscal year 2010. Non-GAAP Financial Measures To supplement the financial measures calculated in accordance with GAAP, this press release includes certain non-GAAP financial measures of adjusted net income and adjusted diluted earnings per ordinary share and per ADS, each of which is adjusted to exclude items related to share-based compensation, non-cash interest expense, the gain on bargain purchase from an acquisition and the amortization of intangible assets arising from purchase price allocation in connection with a series of acquisitions of equity interests in Tianwei Yingli. The Company believes excluding these items from its non-GAAP financial measures is useful for its management and investors to assess and analyze the Company's core operating results as such items are not directly attributable to the underlying performance of the Company's business operations and do not impact its cash earnings. The Company also believes these non-GAAP financial measures are important to help investors understand the Company's current financial performance and future prospects and compare business trends among different reporting periods on a consistent basis. These non-GAAP financial measures should be considered in addition to financial measures presented in accordance with GAAP, but should not be considered as a substitute for, or superior to, financial measures presented in accordance with GAAP. For a reconciliation of each of these non-GAAP financial measures to the most directly comparable GAAP financial measure, please see the financial information included elsewhere in this press release. Currency Conversion Solely for the convenience of readers, certain Renminbi amounts have been translated into U.S. dollar amounts at the rate of RMB 6.4635 to US$1.00, the noon buying rate in New York for cable transfers of Renminbi per U.S. dollar as set forth in the H.10 weekly statistical release of the Federal Reserve Board as of June 30, 2011. No representation is intended to imply that the Renminbi amounts could have been, or could be, converted, realized or settled into U.S. dollar amounts at such rate, or at any other rate. The percentages stated in this press release are calculated based on Renminbi. Conference Call Yingli Green Energy will host a conference call and live webcast to discuss the results at 8:00 AM Eastern Daylight Time (EDT) on August 19, 2011, which corresponds to 8:00 PM Beijing/Hong Kong time on the same day. The dial-in details for the live conference call are as follows:

A live and archived webcast of the conference call will be available on the Investors section of Yingli Green Energy's website at www.yinglisolar.com. A replay will be available shortly after the call on Yingli Green Energy's website for 90 days. A replay of the conference call will be available until August 26, 2011 by dialing:

About Yingli Green Energy Yingli Green Energy Holding Company Limited (NYSE: YGE), which markets its products under the brand "Yingli Solar," is a leading solar energy company and one of the world's largest vertically integrated photovoltaic manufacturers. Yingli Green Energy's manufacturing covers the entire photovoltaic value chain, from the production of polysilicon through ingot casting and wafering, to solar cell production and module assembly. Currently, Yingli Green Energy maintains a balanced vertically integrated production capacity of over 1 GW per year. Two capacity expansion projects of 600 MW and 100 MW in Baoding and Hainan, respectively, started initial production in early July 2011 and are expected to increase the Company's total nameplate capacity to 1.7 GW in late 2011. In addition, Yingli Green Energy's in-house polysilicon plant, Fine Silicon, which has a designed annual production capacity of 3,000 metric tons, has successfully started commercial operation in early August 2010. Yingli Green Energy distributes its photovoltaic modules to a wide range of markets, including Germany, Spain, Italy, Greece, France, South Korea, China and the United States. Headquartered in Baoding, China, Yingli Green Energy has more than 11,000 employees and more than 10 subsidiaries and branch offices worldwide. Yingli Green Energy is publicly listed on the New York Stock Exchange (NYSE: YGE). For more information, please visit http://www.yinglisolar.com. Safe Harbor Statement This press release contains forward-looking statements. These statements constitute "forward-looking" statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "target" and similar statements. Such statements are based upon management's current expectations and current market and operating conditions, and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond Yingli Green Energy's control, which may cause Yingli Green Energy's actual results, performance or achievements to differ materially from those in the forward- looking statements. Further information regarding these and other risks, uncertainties or factors is included in Yingli Green Energy's filings with the U.S. Securities and Exchange Commission. Yingli Green Energy does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under applicable law.

SOURCE Yingli Green Energy Holding Company Limited |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

英利绿色能源公布了2011财年第二季度财务报告:实现净营收6.806亿美元(合人民币43.988亿元),环比增加27.4%;光伏组件发货量较上一季度增涨36.6%;毛利润1.501亿美元(合9.701亿元人民币),毛利率为22.1%;运营利润8140万美元,运营利润率12%;净利润5810万美元。

微信客服

微信客服 微信公众号

微信公众号

0 条