但在经济视点报记者的采访中,该公司相关负责人却认为其报道与实际情况有很大差距。

3月22日,偃师市晴空万里。

在洛阳中硅高科技有限公司(以下简称洛阳中硅)偃师生产厂区内,芳草茵茵,围墙外粉红的桃花、墨绿的麦苗在微风中轻轻摇曳。

然而就是这样一片颇具春意、生机盎然的田园春色,正遭受着一场舆论批评的风暴。

近日,美国《华盛顿邮报》一篇关于洛阳中硅高科技有限公司“环保欠账”的报道使其陷入尴尬境地。该报道称,洛阳中硅随意倾倒工业副产品,污染环境。

“他们存在偏见,报道与实际情况有很大的差距。”该公司董事会秘书望海龙对于外媒的报道,显得既愤怒又很无奈。

在最近公布的“大部制改革”方案中,国家环保总局升格为环保部,政府对环保的重视达到了前所未有的程度。环保问题,正成为一个企业甚至一个产业兴败存亡的衡量标准,也难怪望海龙情绪如此激动。

“白沫”风波

洛阳中硅成立于2003年,是我国第一家拥有自主知识产权的多晶硅生产厂家。截至目前,洛阳中硅先后在偃师高龙镇和洛龙高新区建成了两个面积分别为200亩和860亩的生产厂区,去年年产量已达506吨,而当年全国的产量还不到1000吨,中硅的产量在全国占60%以上。

作为一家被寄予厚望的高新技术企业,洛阳中硅在2007年却面临尴尬。

据偃师市白牛村的村民介绍,在2007年,有段时间经常见到厂里的大卡车运送一桶桶的“白沫”,倾倒在村小学附近。

“我们并不知道‘白沫’是什么,但是倒在小学附近,而且有异味,很容易引起大家恐慌。”因此,村民就及时向相关部门反映了情况。没多久,那些“白沫”又被挖走了。

有人认为,“白沫”就是四氯化硅。多晶硅广泛应用于太阳能电池领域,洛阳中硅是新兴的绿色能源企业,但是生产多晶硅的主要副产品四氯化硅却是剧毒物质。

但望海龙却告诉记者,倾倒四氯化硅之事纯属子虚乌有,所谓的“白沫子”并不是四氯化硅,而是水和二氧化硅的混合物,原本呈酸性,被中和后才拉出工厂运到指定垃圾场,且毒害小。去年9月的事件是垃圾车翻倒在路边造成的意外事件,玉米也并非被毒死而是被车压坏的,事件已得到及时处理,并赔偿了相关受损农民。毒气也是不存在的,仅在2005年年底,由于机器调试过程中阀门出现故障,发生了气体泄露的事故,之后再也没有出现过类似事件。

望海龙认为,洛阳中硅对环保问题是非常重视且非常谨慎的。

在多晶硅生产中,四氯化硅的处理是多晶硅生产工艺的核心技术之一。目前该技术主要掌握在西方发达国家手中,其对四氯化硅的处理主要有两种途径:交给硅产业链中的下游生产厂家即一些化工厂,进行可用产品的再生产;或者是将四氯化硅氢化,还原为无毒的三氯化硅再进行处理。洛阳中硅的主要处理方式是进行冷凝、分离,然后再回收进行氢化处理,将转化物外销给化工厂。

刚起步的产业

多晶硅产业作为太阳能产业的原料生产部分,目前在很多国家都被看作是战略技术产业。多晶硅产业在世界范围内已有近50年的发展历史,目前世界上多晶硅生产的先进技术,主要掌握在美国、日本和德国3个国家手中,并被这些国家长期垄断。而中国的多晶硅生产工业发展还不到30年,且很多工厂仅为作坊式的小产量生产而非产业化生产。

目前,我国大部分多晶硅生产企业还在使用污染严重、产量低下的传统西门子工艺,而洛阳中硅使用的是拥有国家专利的改良西门子工艺,该工艺在当前国际的多晶硅生产中使用率为80%以上,属主流工艺。

洛阳中硅是我国第一家拥有自主知识产权的多晶硅生产厂家,并在国内率先打破西方国家的技术封锁,实现多晶硅产业化生产,填补了国内大规模生产多晶硅的技术空白。

多晶硅作为太阳能产业的主要原料,主要用于太阳能光伏发电产业和IC电子信息产业。近几年,随着我国太阳能产业的快速发展,国内对多晶硅的需求不断上涨,每年大概需要6000吨的多晶硅,而国内的产量还不足1000吨,因此,我国95%的多晶硅都要依靠国外进口。

望海龙认为,中国需要有自己的产业化多晶硅生产企业。

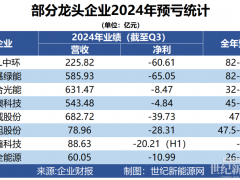

洛阳中硅经过5年的发展,在全国达到了产量第一、技术第一的龙头地位。在洛阳中硅快速发展的带动下,洛阳形成了一条巨大的硅产业链,对河南和洛阳的经济起到了巨大的带动作用。预计到2010年,洛阳的硅产业链将超过120亿的产值。

与巨大的经济效益相比,中硅高科给中国多晶硅产业带来的技术革新和突破是难以估量的。中硅高科技有限公司的研发中心,为中硅提供技术支持,主要包括对已建成的生产线进行技术完善和开发新的生产工艺。去年12月28日,该研发中心被省发改委定为河南省多晶硅技。

原文链接

http://www.washingtonpost.com/wp-dyn/content/article/2008/03/08/AR2008030802595.html

Solar Energy Firms Leave Waste Behind in China# o

$ B

By Ariana Eunjung Cha

Washington Post Foreign Service

Sunday, March 9, 2008; A01

GAOLONG, China -- The first time Li Gengxuan saw the dump trucks from the nearby factory pull into his village, he couldn't believe what happened. Stopping between the cornfields and the primary school playground, the workers dumped buckets of bubbling white liquid onto the ground. Then they turned around and drove right back through the gates of their compound without a word.

This ritual has been going on almost every day for nine months, Li and other villagers said.

In China, a country buckling with the breakneck pace of its industrial growth, such stories of environmental pollution are not uncommon. But the Luoyang Zhonggui High-Technology Co., here in the central plains of Henan Province near the Yellow River, stands out for one reason: It's a green energy company, producing polysilicon destined for solar energy panels sold around the world. But the byproduct of polysilicon production -- silicon tetrachloride -- is a highly toxic substance that poses environmental hazards.

"The land where you dump or bury it will be infertile. No grass or trees will grow in the place. . . . It is like dynamite -- it is poisonous, it is polluting. Human beings can never touch it," said Ren Bingyan, a professor at the School of Material Sciences at Hebei Industrial University.

The situation in Li's village points to the environmental trade-offs the world is making as it races to head off a dwindling supply of fossil fuels.

Forests are being cleared to grow biofuels like palm oil, but scientists argue that the disappearance of such huge swaths of forests is contributing to climate change. Hydropower dams are being constructed to replace coal-fired power plants, but they are submerging whole ecosystems under water.

Likewise in China, the push to get into the solar energy market is having unexpected consequences.

With the prices of oil and coal soaring, policymakers around the world are looking at massive solar farms to heat water and generate electricity. For the past four years, however, the world has been suffering from a shortage of polysilicon -- the key component of sunlight-capturing wafers -- driving up prices of solar energy technology and creating a barrier to its adoption.

With the price of polysilicon soaring from $20 per kilogram to $300 per kilogram in the past five years, Chinese companies are eager to fill the gap.

In China, polysilicon plants are the new dot-coms. Flush with venture capital and with generous grants and low-interest loans from a central government touting its efforts to seek clean energy alternatives, more than 20 Chinese companies are starting polysilicon manufacturing plants. The combined capacity of these new factories is estimated at 80,000 to 100,000 tons -- more than double the 40,000 tons produced in the entire world today.

But Chinese companies' methods for dealing with waste haven't been perfected.

Because of the environmental hazard, polysilicon companies in the developed world recycle the compound, putting it back into the production process. But the high investment costs and time, not to mention the enormous energy consumption required for heating the substance to more than 1800 degrees Fahrenheit for the recycling, have discouraged many factories in China from doing the same. Like Luoyang Zhonggui, other solar plants in China have not installed technology to prevent pollutants from getting into the environment or have not brought those systems fully online, industry sources say.

"The recycling technology is of course being thought about, but currently it's still not mature," said Shi Jun, a former photovoltaic technology researcher at the Chinese Academy of Sciences.

Shi, chief executive of Pro-EnerTech, a start-up polysilicon research firm in Shanghai, said that there's such a severe shortage of polysilicon that the government is willing to overlook this issue for now.

"If this happened in the United States, you'd probably be arrested," he said.

An independent, nationally accredited laboratory analyzed a sample of dirt from the dump site near the Luoyang Zhonggui plant at the request of The Washington Post. The tests show high concentrations of chlorine and hydrochloric acid, which can result from the breakdown of silicon tetrachloride and do not exist naturally in soil. "Crops cannot grow on this, and it is not suitable for people to live nearby," said Li Xiaoping, deputy director of the Shanghai Academy of Environmental Sciences.

Wang Hailong, secretary of the board of directors for Luoyang Zhonggui, said it is "impossible" to think that the company would dump large amounts of waste into a residential area. "Some of the villagers did not tell the truth," he said.

However, Wang said the company does release a "minimal amount of waste" in compliance with all environmental regulations. "We release it in a certain place in a certain way. Before it is released, it has gone through strict treatment procedures."

Yi Xusheng, the head of monitoring for the Henan Province Environmental Protection Agency, said the factory had passed a review before it opened, but that "it's possible that there are some pollutants in the production process" that inspectors were not aware of. Yi said the agency would investigate.

In 2005, when residents of Li's village, Shiniu, heard that a new solar energy company would be building a factory nearby, they celebrated.

The impoverished farming community of roughly 2,300, near the eastern end of the Silk Road, had been left behind during China's recent boom. In a country where the average wage in some areas has climbed to $200 a month, many of the village's residents make just $200 a year. They had high hopes their new neighbor would jump-start the local economy and help transform the area into an industrial hub.

The Luoyang Zhonggui factory grew out of an effort by a national research institute to improve on a 50-year-old polysilicon refining technology pioneered by Germany's Siemens. Concerned about intellectual property issues, Siemens has held off on selling its technology to the Chinese. So the Chinese have tried to create their own.

Last year, the Luoyang Zhonggui factory was estimated to have produced less than 300 tons of polysilicon, but it aims to increase that tenfold this year -- making it China's largest operating plant. It is a key supplier to Suntech Power Holdings, a solar panel company whose founder Shi Zhengrong recently topped the list of the richest people in China.

Made from the Earth's most abundant substance -- sand -- polysilicon is tricky to manufacture. It requires huge amounts of energy, and even a small misstep in the production can introduce impurities and ruin an entire batch. The other main challenge is dealing with the waste. For each ton of polysilicon produced, the process generates at least four tons of silicon tetrachloride liquid waste.

When exposed to humid air, silicon tetrachloride transforms into acids and poisonous hydrogen chloride gas, which can make people who breathe the air dizzy and can make their chests contract.

While it typically takes companies two years to get a polysilicon factory up and running properly, many Chinese companies are trying to do it in half that time or less, said Richard Winegarner, president of Sage Concepts, a California-based consulting firm.

As a result, Ren of Hebei Industrial University said, some Chinese plants are stockpiling the hazardous substances in the hopes that they can figure out a way to dispose of it later: "I know these factories began to store silicon tetrachloride in drums two years ago."

Pro-EnerTech's Shi says other companies -- including Luoyang Zhonggui -- are just dumping wherever they can.

"Theoretically, companies should collect it all, process it to get rid of the poisonous stuff, then release it or recycle. Zhonggui currently doesn't have the technology. Now they are just releasing it directly into the air," said Shi, who recently visited the factory.

Shi estimates that Chinese companies are saving millions of dollars by not installing pollution recovery.

He said that if environmental protection technology is used, the cost to produce one ton is approximately $84,500. But Chinese companies are making it at $21,000 to $56,000a ton.

In sharp contrast to the gleaming white buildings in Zhonggui's new gated complex in Gaolong, the situation in the villages surrounding it is bleak.

About nine months ago, residents of Li's village, which begins about 50 yards from the plant, noticed that their crops were wilting under a dusting of white powder. Sometimes, there was a hazy cloud up to three feet high near the dumping site; one person tending crops there fainted, several villagers said. Small rocks began to accumulate in kettles used for boiling faucet water.

Each night, villagers said, the factory's chimneys released a loud whoosh of acrid air that stung their eyes and made it hard to breath. "It's poison air. Sometimes it gets so bad you can't sit outside. You have to close all the doors and windows," said Qiao Shi Peng, 28, a truck driver who said he worries about his 1-year-old son's health.

The villagers said most obvious evidence of the pollution is the dumping, up to 10 times a day, of the liquid waste into what was formerly a grassy field. Eventually, the whole area turned white, like snow.

The worst part, said Li, 53, who lives with his son and granddaughter in the village, is that "they go outside the gates of their own compound to dump waste."

"We didn't know how bad it was until the August harvest, until things started dying," he said.

Early this year, one of the villagers put some of the contaminated soil in a plastic bag and went to the local environmental bureau. They never got back to him.

Zhang Zhenguo, 45, a farmer and small businessman, said he has a theory as to why: "They didn't test it because the government supports the plant."

Researchers Wu Meng and Crissie Ding contributed to this report.

微信客服

微信客服 微信公众号

微信公众号

0 条